missoula montana sales tax rate

2022 Montana state sales tax. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0.

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

Wayfair Inc affect Montana.

. Sales tax region name. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----. Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year.

Sales Tax and Use Tax Rate of Zip Code 59802 is located in Missoula City Missoula County Montana State. The Missoula Montana sales tax is NA the same as the Montana state sales tax. 0 State Sales tax is -----NA-----.

There is 0 additional tax districts that applies to some areas geographically within Missoula. Tax rates are provided by Avalara and updated monthly. These taxes are in addition to the state taxes.

Local-option tax rates are set by the county up to a maximum of 3 on medical adult-use or both. The December 2020 total. 9 rows Montana has a 0 sales tax and Missoula County collects an additional NA so the minimum.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. The Montana sales tax rate is currently.

Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected. The Missoula sales tax rate is NA. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000.

Sales Tax and Use Tax Rate of Zip Code 59812 is located in Missoula City Missoula County Montana State. The US average is 73. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

2022 Montana Sales Tax Table. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

The sales tax rate does not vary based on zip code. The notices for the 2019-2020 appraisal cycle are. A full list of these can be found below.

Look up 2022 sales tax rates for East Missoula Montana and surrounding areas. The County sales tax rate is. 0 State Sales tax is -----NA-----.

The most populous location in Missoula County Montana is Missoula. The US average is 28555 a year. The Montana MT state sales tax rate is currently 0.

If you need specific tax information or property records about a property in Missoula County contact the Missoula County Tax Assessors Office. Sales Tax and Use Tax Rate of Zip Code 59803 is located in Missoula City Missoula County Montana State. 0 State Sales tax is -----NA-----.

The most populous zip code in Montana is 59901. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. A full list of locations in.

Tax Rates for Missoula - The Sales Tax Rate for Missoula is 00. There are additional taxes. The US average is 46.

Within Missoula there are around 8 zip codes with the most populous zip code being 59801. The most populous county in Montana is Yellowstone County. Download all Montana sales tax rates by zip code.

0 State Sales tax is -----NA-----. Exact tax amount may vary for different items. Tax rates last updated in April 2022.

The sales tax rate does not vary based on zip code. Has impacted many state nexus laws and sales tax collection requirements. The sales tax rate does not vary based on location.

The 2018 United States Supreme Court decision in South Dakota v. The most populous zip code in Missoula County Montana is 59801. Montana is one of only five states without a general sales tax.

The sales tax rate does not vary based on location. - The Income Tax Rate for Missoula is 69. The sales tax rate does not vary based on zip code.

The Department of Revenue a division of the State of Montanas government determines the market value of residential and commercial property once every two years. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The state sales tax rate in Montana is 0 but you can.

The average cumulative sales tax rate in Missoula Montana is 0. Montana has no state sales tax and allows local. Did South Dakota v.

Income and Salaries for Missoula - The average income of a Missoula resident is 25275 a year. State taxes are set by the Montana Legislature while local-option taxes are optionally enacted by counties. 362 013 341st of 3143 093 003 1250th of 3143 Note.

Sales Tax and Use Tax Rate of Zip Code 59806 is located in Missoula City Missoula County Montana State. State taxes are set at 4 for medical marijuana and 20 for adult-use sales. The average cumulative sales tax rate between all of them is 0.

368 rows Average Sales Tax With Local. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----. This page provides general information about property taxes in Missoula County.

This includes the rates on the state county city and special levels. The Missoula sales tax rate is. - Tax Rates can have a big impact when Comparing Cost of Living.

This means that depending on your location within Montana the total tax you pay can be significantly higher than the 0 state sales tax. Missoula is located within Missoula County Montana. 4 rows The current total local sales tax rate in Missoula MT is 0000.

The sales tax rate does not vary based on county. The most populous location in Montana is Billings.

Montana Income Tax Mt State Tax Calculator Community Tax

Mapsontheweb Infographic Map Map Sales Tax

Montana Income Tax Mt State Tax Calculator Community Tax

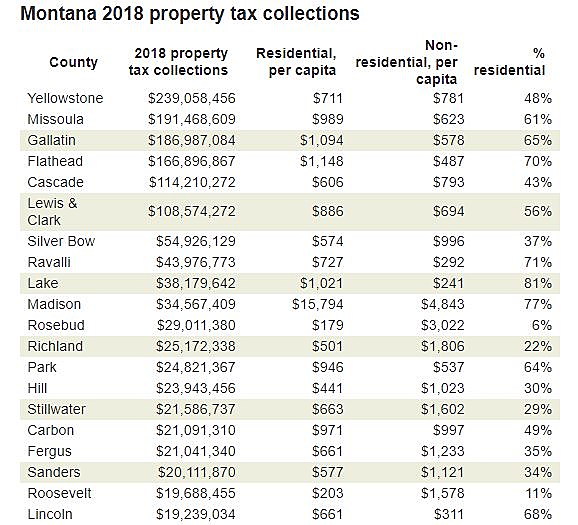

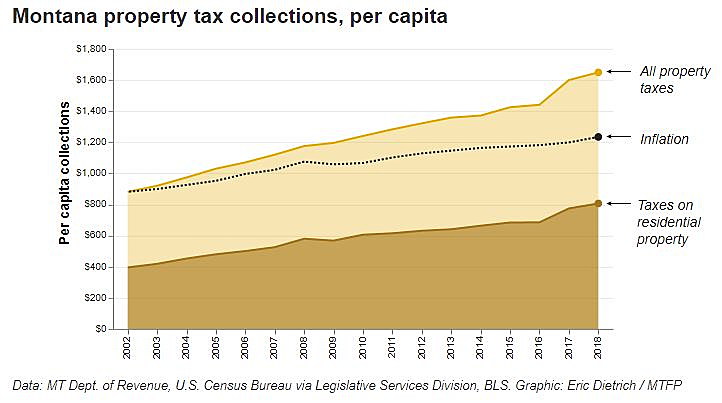

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

The Initiative That Could Upend Montana S Tax System Missoula Current

Our Experienced Advisers Can Help With Hongkong Staff Employment Regulations And Contractual Terms To Internal Communications Business Names Human Resources

File Sales Tax By County Webp Wikimedia Commons

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Chamber Of Commerce Holds Listening Session In Missoula State Regional Helenair Com

Montana Sales Tax Rates By City County 2022

Montana Chamber Of Commerce Holds Listening Session In Missoula State Regional Helenair Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)